Advanced Micro Solutions — 1099-Etc

Sep. 09, 2011

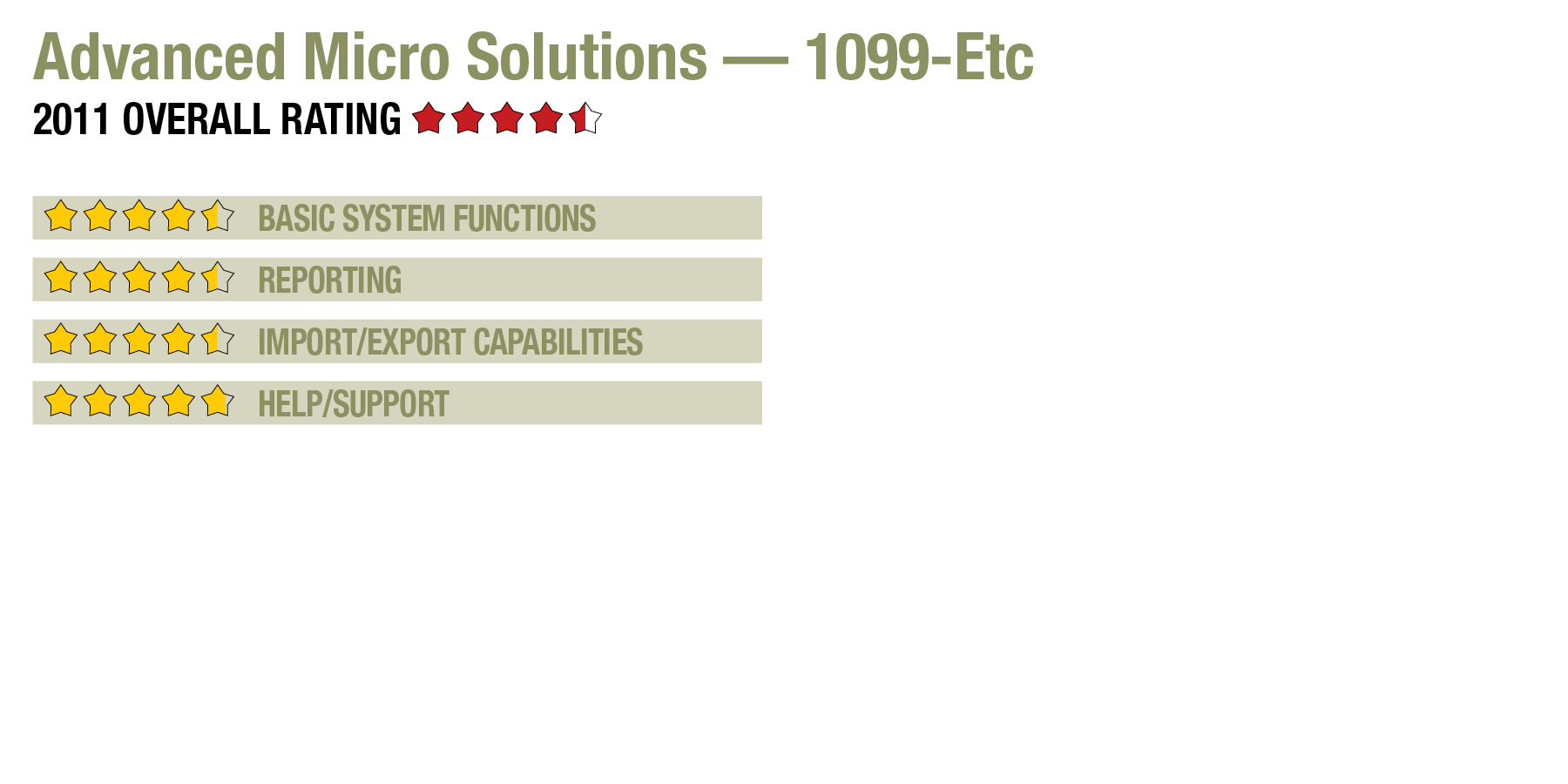

2011 Overall Rating 4.5

Best Fit

Accounting practices performing after-the-fact payroll, quarterly and year-end information reporting for multiple clients.

Strengths

- Excellent interface, client management screens.

- Extensive federal, state & local forms library along with e-filing.

- Option for outsourcing printing & mailing of all recipient copies.

- Imports from outside accounting & other programs via several formats.

- Comprehensive payroll functionality.

Potential Limitations

- No local reporting capabilities.

Summary & System Pricing

Although 1099-Etc can be used directly by small and mid-sized businesses, AMS has concentrated development of the system toward multi-client management functions, resulting in more than 80% of its users being accounting firms and payroll service providers. With the addition of the live payroll and electronic filing modules, the full AMS suite offers an extremely easy-to-use and affordably priced utility for managing employment, wage, and information reporting for federal and all states. The core 1099-Etc system costs $75 per year, but to get the full functionality, users should also add the $75 laser generation options, the $105 A-T-F payroll module and the $105 e-file utility. These options, usable by any number of staff in the same office, would cost $360 per year.

Product Delivery Methods

_X_ On-Premises

___ SaaS

___ Hosted by Vendor

Basic System Functions 4.5

Reporting 4.5

Import/Export Capabilities 4.5

Help/Support 4.75