Payroll

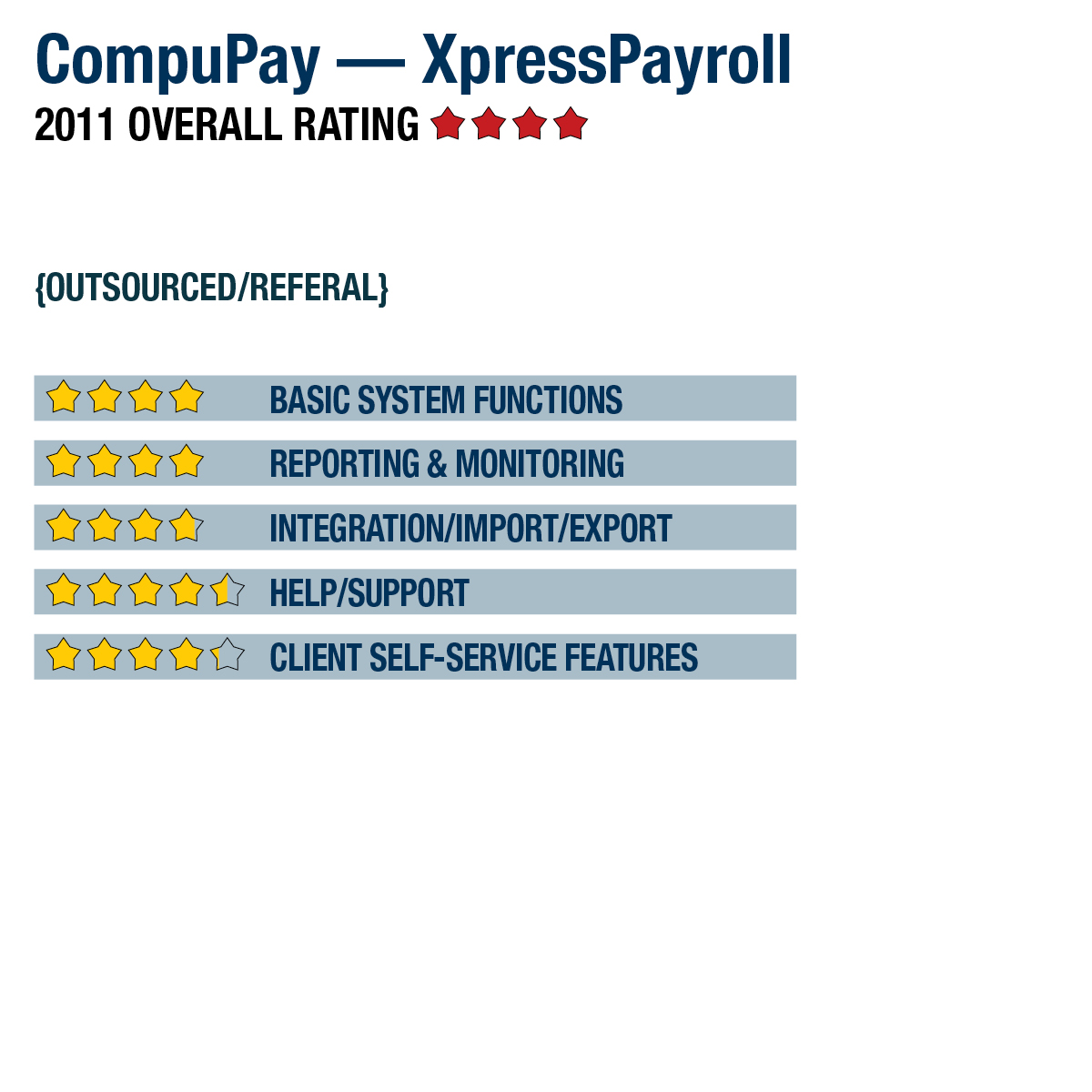

CompuPay — XpressPayroll

Aug. 10, 2011

877-729-6299

www.compupay.com

2011 Overall Rating 4.25

Best Fit

The XpressPayroll for Accountants wholesale version is a good fit for accounting professionals who want to work with client payroll without implementing an in-house payroll application or preparing payroll tax returns. It’s also designed for organizations with a total of five or fewer paid employees in one state.

Strengths

- Each company comes with a single client login, along with optional accountant access.

- Reports & websites in the wholesale version can be branded with the accounting firm’s logo.

- Flat-fee monthly pricing ($35/mo. for monthly payroll) makes costs predictable.

- Clean user interface provides quick efficient payroll processing.

- Included employee self-service portal (PayView) can be configured to allow pay stub and W-2 download for all employees, as well as company-wide reporting for owners & managers.

Potential Limitations

- Does not support after-the-fact payroll processing.

- No online Help or knowledgebase available, although there is phone & e-mail support.

SUMMARY & PRICING

With the simple interface, high level of customer support and rich feature set, XpressPayroll provides a quality solution for both micro businesses and accounting professionals managing multiple clients (through XpressPayroll for Accountants). Pricing for the payroll services is a flat fee and is charged per month based on the payroll frequency. Monthly pricing starts around $35 for monthly payroll, $55 for semi-monthly and bi-weekly payroll, and $80 for weekly payroll.

Product Delivery Methods

___ On-Premises

_X_ SaaS

___ Hosted by Vendor

Basic System Functions 4

Reporting & Monitoring 4

Integration/Import/Export 3.75

Help/Support 4.5

Client Self-Service Features 4.25