Payroll

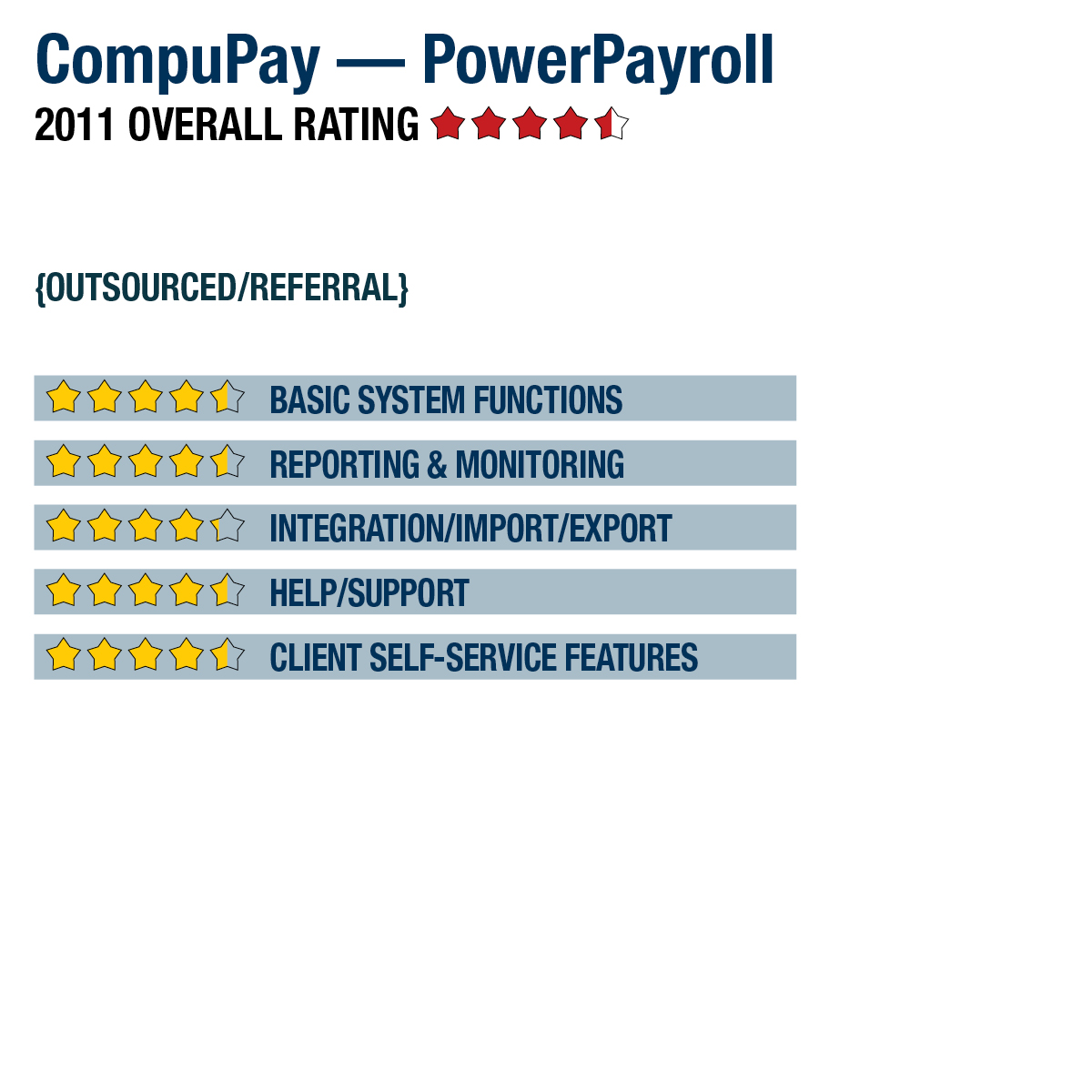

CompuPay — PowerPayroll

Aug. 10, 2011

877-729-6299

www.compupay.com

2011 Overall Rating 4.5

Best Fit

Accountants or companies who need a web-based payroll application with outsourced tax filing and payment processing services, as well as organizations that need to manage payroll for businesses with less than 200 total employees.

Strengths

- Offers all-inclusive, full-service payroll with support for unlimited application users.

- Garnishments, benefit accrual calculations, general ledger export and support for multi-state withholding for employees available for an additional charge.

- CompuPay assists clients with initial setup of employees, deductions, vacation/sick time accruals and other information.

- Included employee self-service portal can be configured to allow pay stub & W-2 download.

Potential Limitations

- Certified payroll & job cost reporting not supported.

SUMMARY & PRICING

PowerPayroll provides an easy-to-use product with a high level of support and is a cost-effective solution for small businesses that do not have the resources to dedicate to a full-time payroll or human resource staff person. Pricing is based on the number of employees within the company and the frequency of the payroll runs. Each base fee includes direct deposit and one native home state. Additional charges for services such as garnishments, time accruals and GL export are each available for an additional fee. A 10-employee business processing payroll either biweekly or semimonthly is currently priced at $67.75 per employee, per payroll run. This price includes all tax services, direct deposit, new hire reporting and some online self-service HR functions.

Product Delivery Methods

___ On-Premises

_X_ SaaS

___ Hosted by Vendor

Basic System Functions 4.5

Reporting & Monitoring 4.5

Integration/Import/Export 4.25

Help/Support 4.5

Client Self-Service Features 4.5