CFS Tax Software, Inc. — CA and NY Sales Tax Preparer

Sep. 05, 2014

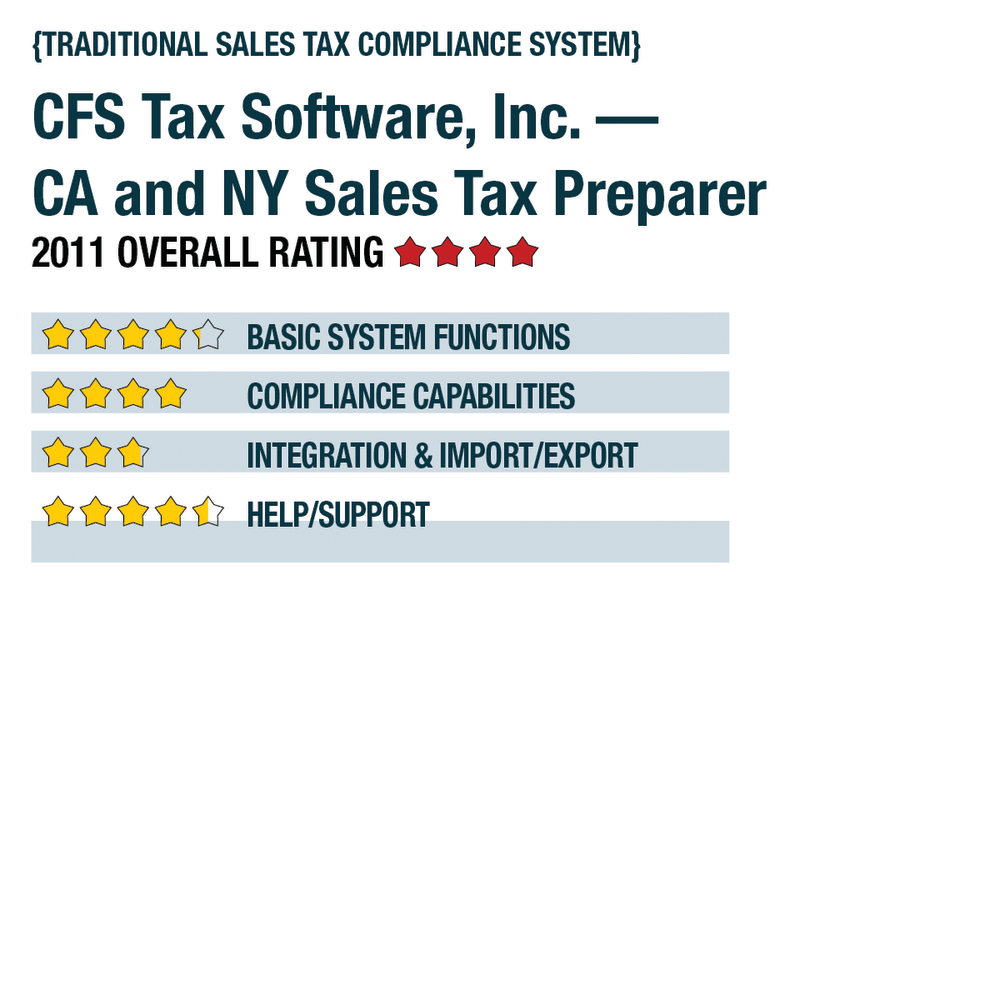

2011 Overall Rating 4

Best Fit:

Small and mid-sized businesses with multiple locations and reporting requirements in CA or NY, or firms managing multiple businesses with such requirements.

Strengths:

- Easy to use

- Gross summary reports

- E-filing to CA

- PDF output

- Good client communication templates

- Multi-client management tools

- Automation of system updates

Potential Limitations:

- Only handles CA and NY returns

- Little e-filing to NY because of state law changes

- No integration with accounting systems

Executive Summary & Pricing

CA Sales Tax Preparer costs $119, with annual renewal priced at $99 and multi-user network version available for $169 ($149 renewal). NY Sales Tax Preparer costs $169, with annual renewal priced at $149 and a multi-user network version available for $219 ($199 renewal). For CA, this pricing includes unlimited preparation, e-filing and electronic payment of returns for any number of business entities. For the NY version, however, changes to New York law have complicated the e-filing procedure, so users are more likely to use the system for preparation only. The systems are simple to use, whether managing one business or several, have great forms libraries and can handle entities with multiple locations within either state.

Product Delivery Methods:

_X_ On-Premises

___ SaaS

___ Hosted by Vendor

Basic System Functions 4.25

Compliance Capabilities 4

Integration/Import/Export 2.75

Help/Support 4.5