Software

Lacerte Tax, an Intuit ProLine Solution

Sep. 05, 2014

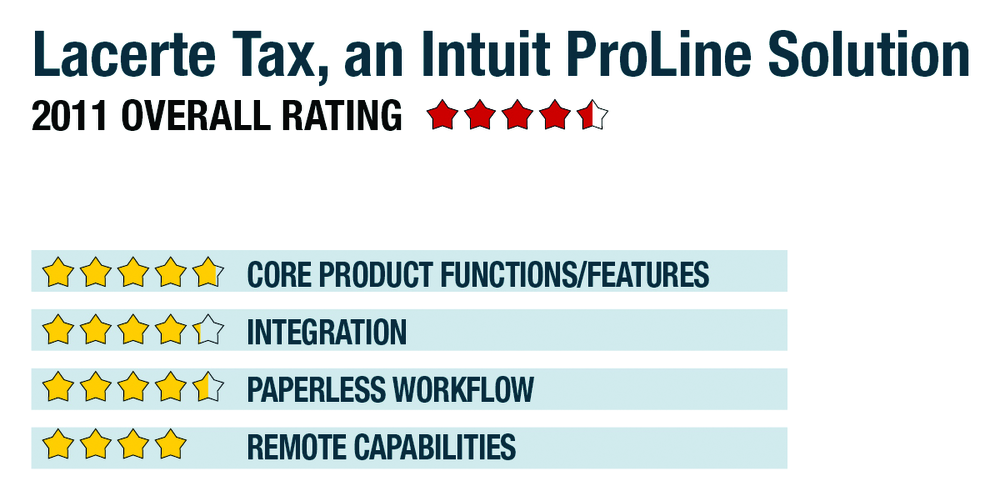

2011 OVERALL RATING 4.50

800-765-7777

www.proline.lacertesoftware.com

Product delivery methods:

__x___ On-Premises

__x___ SaaS

_____ Hosted by Vendor

BEST FIRM FIT:

Competitive solution for small and mid-sized firms with some advanced workflow needs beyond the capabilities of the Traditional Workflow products without the most complex requirements of the Advanced Workflow products like multi-tiered consolidations, multi-office, etc.

STRENGTHS:

- ProLine Tax Import offers a website to help users download and import securities transaction data from investment banks

- Pay-per-return option attractive for startup firms & those who need advanced functionality without a large up-front payment

- New organizer for trust returns, support for using organizer as a workpaper

- This year’s version adds e-filing for state partnership & corporate tax in 23 jurisdictions

- Excellent QuickBooks integration with Lacerte SmartMap tool

POTENTIAL WEAKNESSES:

- Lack of a vendor-hosted or SaaS version of this product, although some third-party hosting companies offer this service

- Client Tracker is not compatible with Windows Vista/Windows 7

- Some supporting applications in the suite are very new (ProLine Practice Management & ProLine Tax Research), and not as complete as the more established competitor products

- Other products (EasyAcct write-up solution) have limited adoption & enhancements

EXECUTIVE SUMMARY & PRICING:

Lacerte Tax can handle a wide range of tax compliance issues and is intended for firms with a complex client base, high-return volume or those who are reliant on its extensive QuickBooks product integration. Pricing has been streamlined, and, for the second year, bundle-based discounts of groups of Intuit practitioner tools are being offered. All bundles include document management solutions as well as entry-level tax planning. Bundles include a various mix of individual and business return modules and range in price from $5,049 to $12,949. Modules may be purchased separately, with business modules starting at $1,579. Per-return-pricing is also available.

4.75 – CORE PRODUCT FUNCTIONS/FEATURES

- · Product depth/multi-state

- · Navigation/ease of use

- · Support for special situations

- · Analytical review

- · Electronic filing

4.25 – INTEGRATION

- · w/in publisher’s own suite

- · w/tax research tools & guidance

- · w/other or external programs

- · w/practice management

- · w/external services

4.5 – PAPERLESS WORKFLOW

- · paperless creation

- · paperless open items

- · paperless review

- · access control for limiting access into returns

- · digital document storage/mgmt.

- · data import/output

4 – REMOTE CAPABILITIES

- portal

- remotes access

- 1099 depot

- Outsourced document prep

- Hosting

- Web-based