Software

CCH, a Wolters Kluwer business — ProSystem fx Tax

Sep. 05, 2014

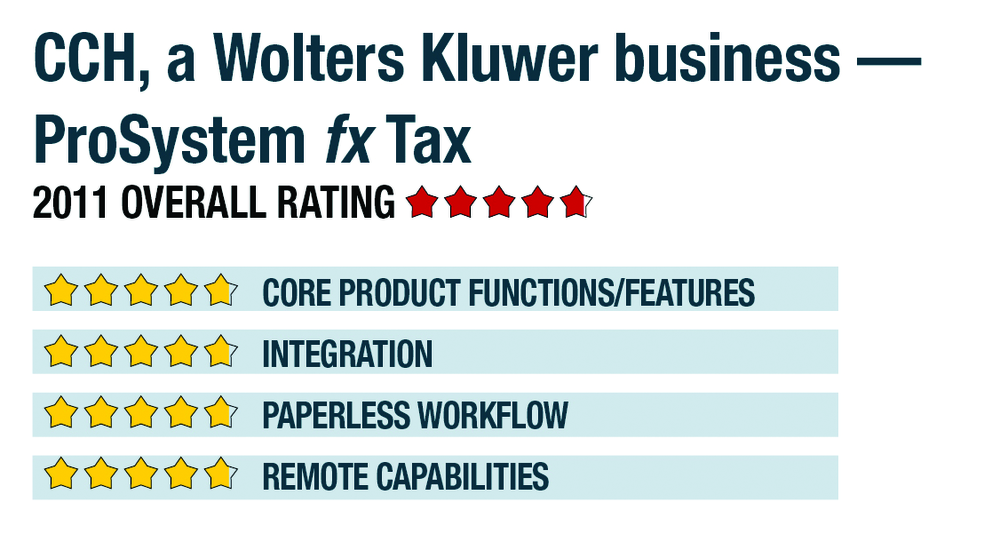

OVERALL RATING 4.75

800-PFX-9998 (739-9998)

CCHGroup.com

Product delivery methods:

__x__ On-Premises

__x___ SaaS

__x___ Hosted by Vendor

BEST FIRM FIT:

An excellent solution for firms of all sizes and those who want the most flexibility in how the application is delivered to end users (local, hosted or public/private cloud).

STRENGTHS:

– Integration with other CCH applications & tools, including ProSystem fx Engagement, Gainskeeper, IntelliConnect & CCH Tax Prep Partner Series

– New Global Integrator tool supports those with multi-national filing or complex consolidation requirements

– Ability to mask confidential data on printed returns offers some additional protection against identity theft & support for outsourced returns

– The only product suite offering an optional locally-installed scan, organize & populate tool (ProSystem fx Scan)

– Strong spreadsheet & GL import capabilities

POTENTIAL LIMITATIONS

– SaaS version (Global fx) requires Internet Explorer 7 or later

– Implementation of IntelliConnect & Next Generation applications in 2010 was a large amount of change in one year for users of these applications

– Supported write-up solutions limited

EXECUTIVE SUMMARY & PRICING:

With traditional and Internet-based solutions available, ProSystem fx Tax fits a wide market range from single users to large multi-user organizations. Pricing for the traditional DVD-based software is $3,585 for the individual tax preparation module and $2,235 for business modules (minus any applicable discounts). State returns are grouped and priced by complexity and start at $435 per state module. Per-return pricing is also available for all modules. Global fx pricing starts at $25 per user, per month with an annual $100 setup fee.

4.75– CORE PRODUCT FUNCTIONS/FEATURES

- · Product depth/multi-state

- · Navigation/ease of use

- · Support for special situations

- · Analytical review

- · Electronic filing

4.75 – INTEGRATION

- · w/in publisher’s own suite

- · w/tax research tools & guidance

- · w/other or external programs

- · w/practice management

- · w/external services

4.75 – PAPERLESS WORKFLOW

- · paperless creation

- · paperless open items

- · paperless review

- · access control for limiting access into returns

- · digital document storage/mgmt.

- · data import/output

4.75 – REMOTE CAPABILITIES

- portal

- remotes access

- 1099 depot

- Outsourced document prep

- Hosting

- Web-based