Software

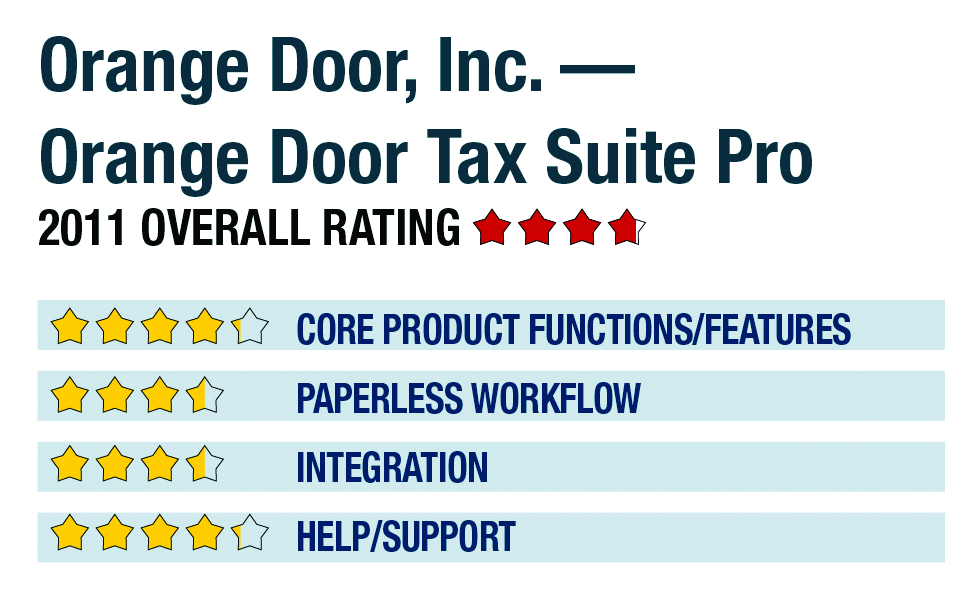

Orange Door, Inc. — Orange Door Tax Suite Pro

Sep. 05, 2014

2011 Overall Rating 3.75

650-952-1773

www.orangedoorinc.com

Product Delivery Methods:

_____ On-Premises

__x__ SaaS

_____ Hosted by Vendor

Best Firm Fit:

Small practice with less complex clients, primarily 1040-focused, who need mobility or remote access, and ability to quickly ramp up/down the number of users

Strengths:

- Fully web-based

- Client portals/collaboration tools

- Instant ramp-up/down for any number of users

- Integrated billing & practice management features

- PC, Mac & Linux friendly

Potential Limitations:

- Limited workflow optimization tools

- Basic PDF output

- Minimal local tax support

Executive Summary & Pricing

The primary benefits of Orange Tax Suite Pro are found in its web-based platform, which allows users to easily access the system from anywhere, and lets firms instantly add users as needed. The program’s importable tax organizers, client portals and integrated document storage system offer additional paperless management utility, although it lacks OCR scan and populate options. The program is best suited toward smaller practices and those with remote staff. It can be used as a pay-per-return system, with all of the document management and portal features, for $20 per 1040 and $30 per business entity, inclusive of all associated state returns and e-filing. An unlimited 1040 package is offered for $1,750, or $2,500 for both unlimited individual and all business entities.

4.25 – Core Product Functions/Features

- product depth/multi-state

- navigation/ease-of-use

- support for special situations

- electronic filing

3.5 – Paperless Workflow

- paperless creation

- paperless open items

- access control for limiting access into returns

- digital document storage/mgmt.

- data import/export

3.5 – Integration

- w/in Publisher’s own suite

- w/tax research tools & guidance

- w/other or external programs

- w/external services

4.25 – Help/Support

- online resource center

- tech assistance availability

- Downloadable program updates

- Preferred SaaS route