Software

Intuit — ProSeries

Sep. 05, 2014

800-934-1040

www.proseries.com

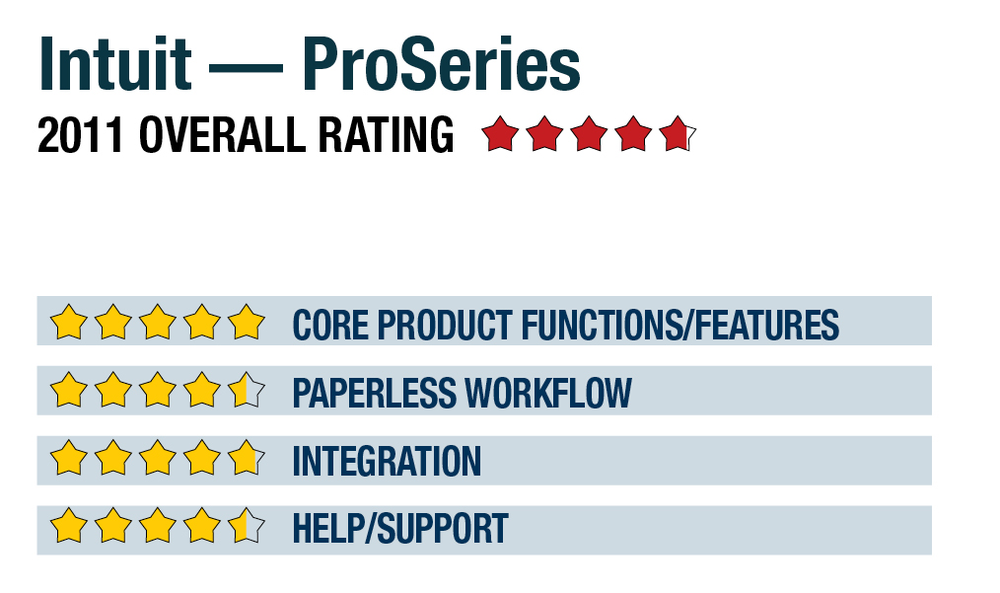

2011 Overall Rating 4.75

Best Firm Fit:

Small to mid-sized firms with mostly 1040s, but also diverse business taxation needs with some moderately complex clients.

Strengths:

– Supports all entities, states & most local taxes

– Options for research, fixed assets, document management & W-2/1099 reporting

– Integrated billing system

– Optional innovative data extraction/import tool combines a scan & organize system and direct download of financial data, where available

Potential Limitations:

– No client portals

– Few internal collaboration tools

– Although add-ons are positive, they add up since system is not all-inclusive

Executive Summary & Pricing:

ProSeries provides the most comprehensive federal, state and local support for tax systems designed for small and mid-sized practices, and the program is available in multiple bundled options that allow for lower volume preparers, or those with low volumes of particular entity types, to still take advantage of the tools that the system offers. These include good optional research, asset depreciation and document management functions, and especially the ProLine Tax Import feature, which provides both scan and organize benefits, as well as direct download of 1098 and 1099 information from client financial institutions. Pricing options allow users to purchase the functionality they need, whether as a pay-per-return model (returns cost $21 each) or in bundles starting at $1,499 for a 1040-focused firm, and up to $4,549 for the most comprehensive version. Any license of the program includes e-filing at no additional charge, and the program can be used by any number of staff within an office location.

Product Delivery Methods

__x__ On-Premises

_____ SaaS

_____ Hosted by Vendor

5 – Core Product Functions/Features

product depth/multi-state

navigation/ease-of-use

support for special situations

electronic filing

4.5 – Paperless Workflow

paperless creation

paperless open items

access control for limiting access into returns

digital document storage/mgmt.

data import/export

4.75 – Integration

w/in Publisher’s own suite

w/tax research tools & guidance

w/other or external programs

w/external services

4.5 – Help/Support

online resource center

tech assistance availability

Downloadable program updates

Preferred SaaS route