Home

Featured….

What the DOL’s Proposed Overtime Rule Means For Small Businesses

Employers Start Offering Emergency Savings Fund Benefit Option

RSM Appoints Ernest Nedder, CPA, as CEO

AICPA Endorses Bipartisan Legislation to Provide Additional Tax Relief to Victims of Natural Disasters

Contributors….

Becky Livingston

Garrett Wagner

Richard D. Alaniz

Randy Johnston

Webinars and CPE….

Webinar: Effortless Tax Prep and Workflow: Say Goodbye to Client Frustrations

CPE Webcast Apr. 2, 2024: The Future of Media & Entertainment: Leveraging Data and Finance

Events….

Accounting

Xerocon 2024 Nashville: Aug. 14-15, 2024

The event will be hosted at the Music City Center, allowing Xero’s community of accountants and bookkeepers from across the U.S., Canada and beyond the chance to connect, as well as options for earning CPE credit.

Accounting

RightNOW Conference 2024

Top influencer keynotes, transformative tech insights and AI innovators converge to elevate the accounting profession at RightNOW 2024. May 14-16, 2024 | Austin, TX.

IRS Touts Strong, More Efficient 2024 Tax Season

It’s Tax Day, so there’s no better time for the IRS to pat itself on the back for a job well done as filing season ends for most Americans.

Cast Your Vote for 2024 Readers’ Choice Awards!

The CPA Practice Advisor Readers’ Choice Awards give readers the opportunity to spotlight the technologies they most rely on and trust to manage their firms.

Technology

The Accounting Technology Lab Podcast – Review of Aiwyn – April 2024

Hosts Randy Johnston and Brian Tankersley, CPA, look at the practice management, billing and collections platform Aiwyn.

Payroll

What the DOL’s Proposed Overtime Rule Means For Small Businesses

The White House just approved a Labor Department proposal to raise the minimum salary exemption to $55,068 per year.

Benefits

Employers Start Offering Emergency Savings Fund Benefit Option

A growing number of companies are making it easier for workers to set aside funds that will help them weather a financial crisis.

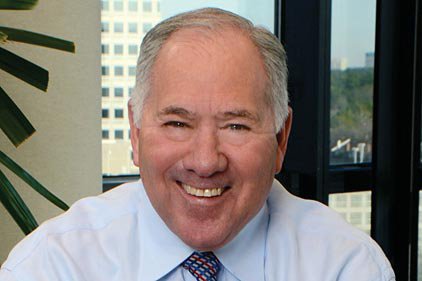

Firm Management

RSM Appoints Ernest Nedder, CPA, as CEO

Over his career, Nedder has developed extensive experience in leading substantial business and digital transformation initiatives, aligning separate service lines, industry verticals and…

![natural_disasters_list_1_.56117a5e5df03[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2021/12/natural_disasters_list_1_.56117a5e5df03_1_.61c1db14bf0ea-768x538.png)

Accounting

AICPA Endorses Bipartisan Legislation to Provide Additional Tax Relief to Victims of Natural Disasters

Under current law, taxpayers affected by a major disaster often have less time to make a refund or credit claim than those who are not affected.

Taxes

Boston IRS Agent Charged With Tax Fraud

Ndeye Amy Thioub was indicted on three counts each of filing false tax returns and filing false tax returns as an employee of the U.S.

Taxes

IRS Raids Home of Rapper Tekashi 6ix9ine, Seizes Cars and Other Items

The rapper, whose legal name is Daniel Hernández, had his property seized for “nonpayment of internal revenue taxes.”

Nonprofit

Only 36% of Not-for-Profits Have Seen an Increase in Funding Following 2022-23 Financial Upheaval

This is a slight improvement over 2023 where only 24 percent of organizations saw an increase in funding while 35 percent saw a decrease.

PCAOB

The PCAOB is Hitting the Road This Year

Board members will host a series of five in-person forums for small audit firms in Chicago, Los Angeles, Denver, Miami, and Jersey City.

Taxes

When Rogue Brokers Switch People’s ACA Policies, Tax Surprises Can Follow

Some tax returns are being rejected because filers failed to provide information about ACA coverage they didn’t know they had.

With Stock Sliding, Tesla Asks Investors to Pay Musk $56 Million

Tesla will ask shareholders to vote on the same $56 billion compensation package for CEO Elon Musk that was voided by a Delaware court early this year.

Auditing

AuditBoard Expands Executive Team to Support Continued Rapid Growth

AuditBoard has brought on public SaaS company veteran Jeff Harper as Chief Human Resources Officer (CHRO) to help scale the organization and infrastructure

Congress Acts on TikTok and Russian Assets

Johnson late on Wednesday unveiled a modified version of the previously House-passed legislation targeting TikTok that would give Chinese owner ByteDance up to a year to divest the app

Technology

75% of Mid-Market Companies to Invest in AI Over Next Five Years, According to Wipfli Survey

The survey sheds light on the evolving landscape of technology investments and workforce dynamics among these businesses, providing valuable insights into their strategies and challenges.

Taxes

IRS Extends RMD Tax Relief for Inherited IRAs

This relief was provided to certain RMDs in 2021, 2022, and 2023, and is being extended in Notice 2024-35 to 2024.

Taxes

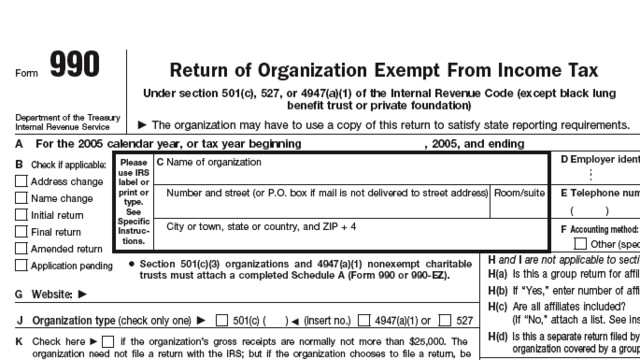

AICPA: Clarification Is Needed for Form 990 Series

The AICPA’s comments also include a matrix for the Form 990 series which focuses on specific sections and the recommendations for those sections.

Marcum Launches AskMarcum.ai

AskMarcum.ai was initially developed for internal use by Marcum Labs, a technology incubator within Marcum LLP, the 13th largest accounting firm in the U.S.

CAS

Attracting and Retaining Clients Starts with Tech Expertise

SMBs rely on their accounting firms for a variety of needs, but one particular area they feel strongly about is having an understanding of the technology they use.

Technology

Thomson Reuters Plans AI Functions for All Professional Users

CoCounsel will unify the entire customer experience and give customers a new way to access Thomson Reuters product capabilities through a single GenAI assistant with applications across Legal, Tax, Risk & Fraud, and Media.

Taxes

Canada Set to Start Taxing Tech Giants This Year Despite U.S. Complaints

The digital services tax currently before Canada’s Parliament would impact U.S.-based companies like Alphabet and Meta Platforms.

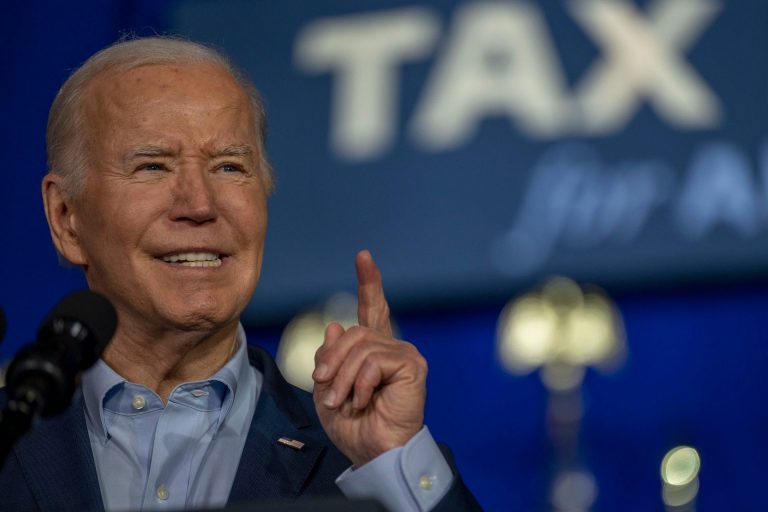

Biden Pitches Tax Plan in Pennsylvania While Trump Stuck in Court

Donald Trump’s recent Truth Social videos and Joe Biden’s message in his hometown of Scranton, PA, showed their vast divide on taxes.

Accounting

AICPA Gives FinCEN Recommendations on RIA Regs

The AICPA has asked FinCEN to reassess the proposed regulations to ensure that there is an appropriate balance between regulatory objectives and practical realities faced by RIAs.

Taxes

Point-of-Sale EV Tax Rebates Are a Hit, Treasury Department Says

Treasury says the federal government has reimbursed more than $580 million to the dealers who offered the tax credit.

Taxes

IRS Updates FAQs on Electric Vehicle Tax Credits

The revised FAQs pertain to the new, previously owned, and qualified commercial clean vehicle credits.

Wolters Kluwer Adds Two Senior Execs

Wolters Kluwer, a provider of information, software, and services for professionals, has announced Atul Dubey as General Manager of its Finance, Risk and Regulatory Reporting (FRR) business

Small Business

A Double Edge to International Supply Chain

The U.S. middle market continues to increase revenue through purchasing and selling products and goods in the international supply chains that connect all corners of the world.

Auditing

AuditFile Introduces Compliance Checklist Tool for 501(c)(3) Organizations

The tool is designed to simplify compliance management for 501(c)(3) organizations, offering an affordable and accessible solution for maintaining regulatory adherence.

Taxes

IRS Says Work-Life Referral Services Are a De Minimis Fringe Benefit

The use of such referral and information services would be excluded from employees’ taxable gross income, according to the IRS.

Small Business

March Saw Increase in Job Growth and Retail Sales

The Census Bureau said overall retail sales in March were up 0.7% seasonally adjusted from February and up 4% unadjusted year over year. That compared with increases of 0.9% month over month and 2.1% year over year in February.

Taxes

Bidens Paid 23.7% Effective Federal Tax Rate in 2023

President Joe Biden and first lady Jill Biden paid $146,629 in federal income taxes on a combined $619,976 in AGI last year.

Taxes

Retirees Are Facing Sizable Tax Bills Due to Fraud

A new Senate committee report sheds light on how older adult scam victims end up with big tax bills and lost retirement savings.

Taxes

Tax Refunds Dropped by 3.3 Percent in 2024

Fewer U.S. taxpayers have received a refund this year in the run-up to tax day compared to 2023, signaling some consumer spending may be disrupted.