Home

Featured….

Corvee Adds Depreciation and Amortization Functions to Instead

Most Accounting Firms Are Shying Away From Using AI—For Now, Survey Finds

Florida Creates New Status for Retired CPAs in the State

PwC Locks Down Top Spot in Vault’s Best Accounting Firms Ranking for 2025

Contributors….

Becky Livingston

Garrett Wagner

Richard D. Alaniz

Randy Johnston

Webinars and CPE….

Webinar: Effortless Tax Prep and Workflow: Say Goodbye to Client Frustrations

CPE Webcast Apr. 2, 2024: The Future of Media & Entertainment: Leveraging Data and Finance

Events….

Accounting

Xerocon 2024 Nashville: Aug. 14-15, 2024

The event will be hosted at the Music City Center, allowing Xero’s community of accountants and bookkeepers from across the U.S., Canada and beyond the chance to connect, as well as options for earning CPE credit.

Accounting

RightNOW Conference 2024

Top influencer keynotes, transformative tech insights and AI innovators converge to elevate the accounting profession at RightNOW 2024. May 14-16, 2024 | Austin, TX.

IRS Touts Strong, More Efficient 2024 Tax Season

It’s Tax Day, so there’s no better time for the IRS to pat itself on the back for a job well done as filing season ends for most Americans.

Cast Your Vote for 2024 Readers’ Choice Awards!

The CPA Practice Advisor Readers’ Choice Awards give readers the opportunity to spotlight the technologies they most rely on and trust to manage their firms.

Firm Management

Accounting Firms Continue to Prioritize Work-Life Balance

The accounting field is still in the midst of a talent shortage that’s causing some firms to turn down clients during busy times.

Taxes

Corvee Adds Depreciation and Amortization Functions to Instead

With Instead and Instead Pro, users can utilize depreciation to find and compare tax savings for assets categorized as residential, nonresidential, technology and …

Technology

Most Accounting Firms Are Shying Away From Using AI—For Now, Survey Finds

While 35% of firms surveyed by Rightworks have no plans to use AI at all, 38% not using AI currently are looking at ways to use it down the road.

![ficpa-logo__large[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/01/ficpa_logo__large_1_.61d751f92fa8d.png)

Accounting Standards

Florida Creates New Status for Retired CPAs in the State

The legislation allows licensed CPAs who are at least 65 years of age to apply to the Florida Board of Accountancy (BOA) to place their license into retired status.

Accounting

PwC Locks Down Top Spot in Vault’s Best Accounting Firms Ranking for 2025

PwC has been ranked the No. 1 best accounting firm to work for by Vault for the last 12 years.

Taxes

Florida Lawyer Gets 8 Years in Prison for Fraudulent Charity Tax Claims

A Florida attorney was sentenced today to eight years in prison for conspiring to defraud the United States and tax evasion.

Taxes

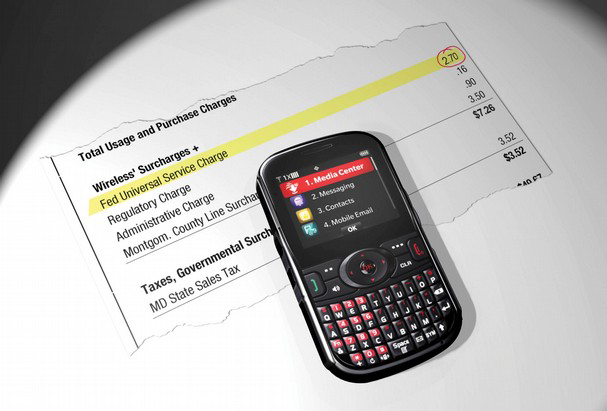

7 Data-Driven Trends Impacting Tax Operations

Despite chronic and pandemic-specific challenges however, the IRS is making strides in returning to business as usual.

Small Business

CFO Optimism Hits 3-Year High

A new survey from Grant Thornton LLP shows that chief financial officers are more optimistic about the U.S. economy than they’ve been in nearly three years.

Taxes

IRS Touts Strong, More Efficient 2024 Tax Season

It’s Tax Day, so there’s no better time for the IRS to pat itself on the back for a job well done as filing season ends for most Americans.

Taxes

IRS Adds More Census Tracts For EV Charger Tax Credit

These additional census tracts were determined to meet the description of eligible census tracts in Notice 2024-20, the IRS said.

TaxDome Completes SOC 2 Type I Audit Examination

This achievement underscores their unwavering commitment to maintaining the highest levels of data security and safeguarding client information.

Artificial Intelligence

How Artificial Intelligence is Revolutionizing the CPA Practice

Embracing innovation, particularly the transformative power of AI, is key to ensuring long-term success in the accounting profession.

Payroll

Many Hiring Managers Ask Illegal Questions During Interviews, Survey Finds

Questions to candidates about citizenship, race, disability, and other characteristics often skirt what’s allowed by law.

Taxes

4 Key Crypto Tax Tips for Entrepreneurs and Digital Investors

By taking the right steps, it’s possible to avoid overpaying taxes and enjoy tax benefits.

Accounting

RightTool Wins 2024 Accountant Bracket Challenge

The QuickBooks automation tool defeated CPA Jason Staats, host of the Jason Daily podcast, in the final by a score of 355-110.

Taxes

Shohei Ohtani’s Ex-Interpreter Charged With Bank Fraud, Stole $16 Million From Baseball Star

Ippei Mizuhara’s involvement in illegal gambling turned up in a far-reaching investigation by federal agencies including the IRS.

Small Business

Retail Sales and Wages Grew in March

This is the sixth month that the Retail Monitor, which was launched in November, has provided data on monthly retail sales.

Technology

Tesla to Launch RoboTaxi on August 8

Tesla Inc. plans to unveil its long-promised robotaxi later this year as the electric carmaker struggles with weak sales and competition from cheap Chinese EVs.

Taxes

Trump Tax Cuts Were Neither Panacea Nor Rip-Off

While the cuts yielded benefits to Americans up and down the income scale, the benefits could best be described as modest.

Auditing

PCAOB Really Flexed Its Enforcement Muscles in 2023

Total enforcement activity reached its highest level since 2017 and monetary penalties doubled compared to the record set in 2022.

Security

The Accounting Technology Lab Podcast – Cybersecurity for High Net Worth Clients – Apr. 2024

Hosts Randy Johnston and Brian Tankersley, CPA, discuss cybersecurity issues and strategies for managing high net worth clients.

Firm Management

Crowe Adds Southern California Accounting Firm KMJ Corbin & Company

KMJ’s audit and tax capabilities and industry sector specialization will offer an unrivalled client experience and augment Crowe’s ability to serve the ever-expanding needs of its client base in California.

Firm Management

CohnReznick Launches Digital Advisory Practice, Aligns with Top Solutions Providers

The digital practice empowers businesses to unlock their full potential through innovative enterprise applications, advanced data analytics, and transformative AI strategies.

Accounting

Fortune Includes 7 CPA Firms in 2024 ‘100 Best Companies to Work For’ List

The same seven public accounting firms that made Fortune’s list for 2023 also made this year’s ranking—just their positioning changed.

Taxes

Feds Cracking Down on Unlawful Tax Return Preparers

Unscrupulous preparers who include errors or false information on a tax return could leave a taxpayer open to liability for unpaid taxes, penalties and interest.

Taxes

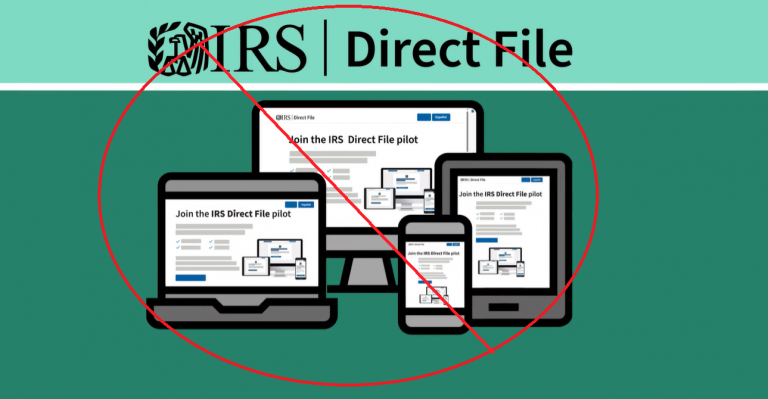

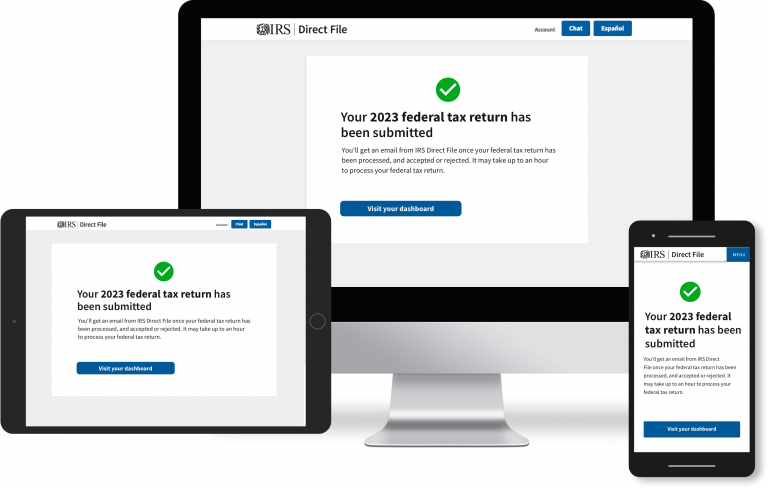

COUNTERPOINT: IRS Should Not Be Trusted With Direct File

Despite its recent trendiness in certain circles, Direct File has little potential for good—and much for bad.

Taxes

POINT: IRS Direct File Simplifies Doing Taxes, Saves Money

The new IRS Direct File tool represents government at its best: saving families time and money.

Payroll

New Grads to Face Active Hiring Market, Higher Starting Salaries

Average starting salaries for entry-level financial reporting accountants are $54k-67K. Internal auditor starting salaries average about $50-55K.

Auditing

PCAOB Proposal Would Require Audit Firms to Disclose a Variety of Metrics

The proposal would direct firms to provide more information, like involvement of partners and auditor turnover, to investors.

Auditing

PCAOB Wallops KPMG Netherlands With Record $25M Fine For Exam Cheating

Rampant cheating on internal training exams occurred from 2017 to 2022 and the firm lied about its knowledge of it, the PCAOB said.

Technology

Webinar: Effortless Tax Prep and Workflow: Say Goodbye to Client Frustrations

Erase client frustration with automated tax return delivery they will want to adopt.

Accounting

Jason Staats Set to Face RightTool in 2024 ABC Tournament Final

Voting for the championship match between CPA Jason Staats and QuickBooks automation tool RightTool ends April 12.