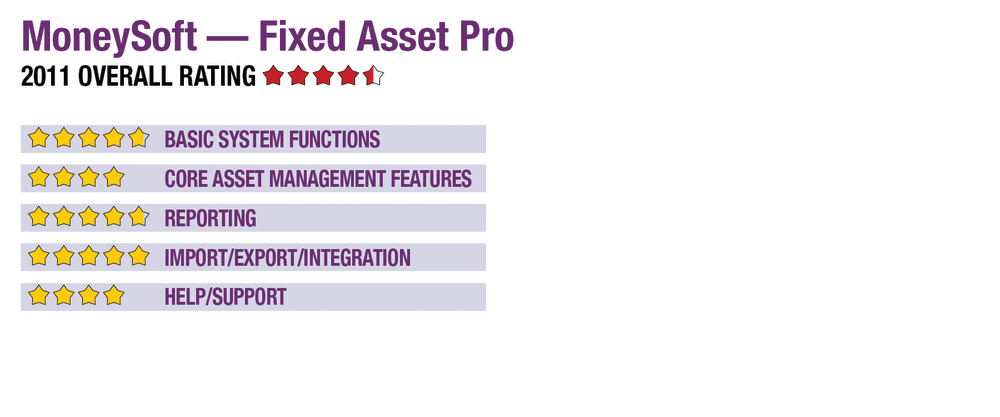

MoneySoft — Fixed Asset Pro

Nov. 02, 2011

Fixed Asset Pro is best suited to medium to large organizations or firms managing their assets and who have asset management strategies of moderate complexity.

Strengths

- Excellent data import & export capabilities

- Robust reporting & customization

- Ability to manage any number of entities & assets

Potential Limitations

- No integrated RFID or barcode scanning for asset audits

- Limited consolidation functions

- No multi-part assets

- No mass acquisition/disposal other than by import

MoneySoft’s Fixed Asset Pro offers asset accounting, depreciation projection and management tools for medium to large enterprises, as well as professional tax and accounting firms serving those entities. The program includes support for departmental and group management of assets, with the ability to track up to six books per asset, and built-in calculations for all traditional depreciation methods and strategies. MoneySoft also offers programs for financial benchmarking, business valuation, and M&A preparation and analysis.

Basic System Functions

Fixed Asset Pro’s initial company and asset setup screens are intuitive and easy to use, guiding the user through data-entry tasks and creation of client defaults for depreciation treatments. Users can also import asset data from a wide selection of file types. The program’s initial interface offers simple pull-down menus for file, setup, calculation, reports, tools and Help, with company selection screens accessible from the file menu. These lists use a basic Windows Explorer file structure, which provides few search and filter options, but the file menu also offers a “reopen” option, which lists recently active client files.

Within a client’s database, the system opens immediately to a master asset list, which offers summary information for all of the assets attached to that entity, including description, tax cost, service date, method, life, Sec. 179 expensing, class and other information. This spreadsheet view can be customized by the user by moving columns and selecting which information is displayed. Tabs are available for moving from this asset listing page to more detailed information on individual assets, a view of an asset’s books, and notes. Icons across the top of the screen offer additional navigation options, including editing company or preparer information, calculations, the pick list, totals, summary reporting and the built-in report builder.

Asset detail screens include selection lists for setting groups, tax class, personal property type, listed property, AMT and ACE type, disposal data and other information, but the main work screen is the Multi-Book Asset Entry tab, which shows each of the asset’s books side-by-side, with fields for cost, method, life, business use, prior accumulation, basis, convention and Sec. 179. As data is entered, the program automatically performs calculations across related fields. Fixed Asset Pro can manage any number of entities with unlimited assets, and supports multiple concurrent users when using a network-ready site license. 4.75

Core Asset Management Features

The program allows up to six books per asset, with preconfigured books for federal tax, financial, AMT, ACE and state, which can be customized as necessary, as well as the ability to create a completely customized asset book. Users have complete control over the methods, conventions and other asset treatments for all books, which can each have differing costs, method, life and other data. This makes it easy to see the affects of variables on depreciation projections for an unlimited number of future years.

The system supports half-year, mid-quarter and mid-month MACRS conventions, along with more than 30 additional MACRS variations, two dozen ACRS methods and several GAAP methods. The system enables management of most asset types, including personal property, all AMT and ACE types, and all tax classes. Other depreciation methods include various straight-line, sum-of-the-years’ digits and other common treatments.

Fixed Asset Pro includes wizards and tools for managing acquisitions and disposals, but not mass actions, partial disposals or splitting of assets. The system can handle sales, exchanges and salvage disposals. Consolidations can be performed between sub entities or departments of the same larger organization. For asset audits, the system offers asset inventory lists, but no direct integration with barcode scanners or RFID utilities. The program’s security features include optional client-level password protection. 4

Reporting

Fixed Asset Pro offers exceptional reporting, with depreciation summaries for each book, monthly GL postings, acquisitions, disposals AMT, ACE, book value, personal property tax, lifetime depreciation projection and asset details. The program includes a built-in report builder that features drag-and-drop functionality and allows total customization of all aspects of reports, from placement and display of desired data to be included, to full header, footer and note design. Reports can be output to Excel, RTF and PDF. The system also prints a form 4562 report. 4.75

Import/Export/Integration

Fixed Asset Pro can import and export data from/to Excel, Word, XML, RTF, PDF, Dbase, Paradox, Lotus 1-2-3, Quattro Pro, SQL and Access. This pretty much ensures that if data exists in digital format, it can be imported into the system, and the program’s data can then be exported into formats used by virtually any financial management program. 5

Help/Support

Fixed Asset Pro’s assistive features include a traditional Help utility along with right-click tools, hot-key functions, and wizards for data import and export. The company doesn’t offer many online support tools, which are limited to live chat, FAQs, articles and a support form. Live phone-based technical support is free with the program, which can be used on modern Windows computers. 4

Summary & Pricing

Fixed Asset Pro can support any number of companies and assets, provides good tools for management of depreciation and Sec. 179 expenses, and has excellent reporting output and customization options. The program costs $599 for a single user, or $699 for the multi-user site license, with annual renewals priced at $189 and $269, respectively.

2011 Overall Rating 4.5

Product Delivery Methods

_X_ On-Premises

___ SaaS

___ Hosted by Vendor