TheTaxBook, published by Tax Materials, Inc.

Sep. 05, 2014

866-919-5277

TheTaxBook is a concise, easy-to-understand topical summary of key tax laws and rules designed for tax preparers. While a full tax research service will be needed for detailed technical guidance on unfamiliar topics, TheTaxBook is designed to provide general guidance, including current rates, per diem amounts, and summaries of law changes from the previous year, and can be used to explain basic provisions of tax law to clients and others.

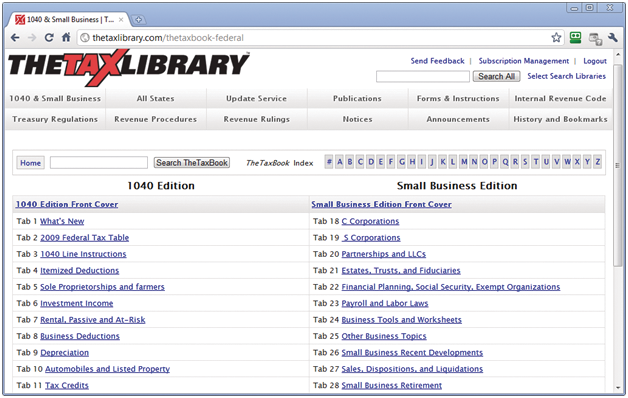

TheTaxBook is published in four separate reference manuals, or editions, including a 1040 Edition for general use when preparing federal income tax returns for individuals, summaries of key provisions of state individual income tax returns in the All States Edition, a Small Business Edition focused on small business tax matters, estates and trusts, and a Deluxe Edition that features the content included in the 1040 and Small Business editions of the guides. Each publication is available as a bound manual or for online access at TheTaxLibrary.com, and subscribers are given a password that allows them access to updates posted throughout the year on the company’s website.

Manuals are priced per edition, from $44 for the 1040 Edition to $76 for the All States Edition, with discounts available for volume purchases. Online access to the web version of the products starts at $89 per year for the first user and $34 for each additional user. Optional access to the state tax summaries included in the print edition of the All States Edition and a searchable library of federal government documents is available for an additional charge. n